In the competitive and highly regulated investment industry, the ability to manage a fund seamlessly from inception to closure is a crucial determinant of success. Fund lifecycle management encompasses every stage—structuring, regulatory compliance, administration, investor relations, and restructuring or wind-up. Partnering with a top-tier fund lifecycle management provider ensures your investment vehicle remains compliant, operationally efficient, and investor-ready at every step.

At FundSetup, we specialize in delivering end-to-end fund lifecycle solutions for fund managers, family offices, and institutional investors across the globe. Our comprehensive approach combines strategic structuring, jurisdictional expertise, technology-driven reporting, and strict compliance oversight, enabling our clients to focus entirely on delivering superior investment performance.

Understanding the Fund Lifecycle Process

The fund lifecycle consists of multiple interconnected phases, each requiring specialized knowledge and meticulous execution:

-

Fund Structuring & Formation – Designing a legal and tax-efficient structure aligned with investor objectives and asset class.

-

Licensing & Regulatory Approvals – Navigating complex local and international regulatory requirements for a smooth launch.

-

Fund Administration – Managing NAV calculations, investor reporting, accounting, and compliance documentation.

-

Investor Onboarding & Relations – Ensuring KYC/AML compliance and maintaining transparent investor communications.

-

Ongoing Compliance & Auditing – Staying updated with jurisdictional rules, FATCA/CRS obligations, and internal audits.

-

Restructuring or Closure – Guiding fund amendments, mergers, or orderly wind-ups while safeguarding investor interests.

Why the Right Fund Lifecycle Partner Matters

A specialized provider is not just a service vendor—they are the operational backbone of your fund. Choosing a reliable partner ensures:

-

Global Regulatory Expertise – Mastery over compliance in major jurisdictions like Cayman Islands, Luxembourg, ADGM, and DIFC.

-

Operational Efficiency – Faster fund launches without compliance delays.

-

Technology-Enhanced Reporting – Real-time access to investor and fund performance data.

-

Risk Mitigation – Ongoing monitoring to prevent costly legal and operational issues.

FundSetup’s Comprehensive Lifecycle Management Services

At FundSetup, our services are designed to cover the full journey of your fund:

1. Fund Structuring & Documentation

We develop bespoke fund structures tailored to your investment strategy, ensuring compliance and maximizing investor appeal. Our documentation process is aligned with international best practices for transparency and efficiency.

2. Jurisdiction Selection

We evaluate tax implications, investor profiles, and regulatory frameworks to recommend the most strategic domicile for your fund.

3. Licensing & Regulatory Filings

From onshore approvals in Dubai to offshore licensing in Cayman or BVI, we manage the complete regulatory process to avoid delays.

4. Fund Administration & Accounting

We provide outsourced administration with services such as NAV calculation, capital call management, and custom investor reporting dashboards.

5. Compliance Monitoring

Our team ensures adherence to AML/KYC, FATCA, CRS, and evolving jurisdictional requirements, minimizing legal exposure.

6. Technology Integration

We implement secure, cloud-based platforms for investor onboarding, fund data storage, and performance analytics.

7. Investor Communication

We strengthen trust by providing regular, accurate, and easy-to-understand updates to investors.

Jurisdictional Expertise at a Global Scale

We have deep experience in leading fund jurisdictions including:

-

Cayman Islands – Dominant hub for hedge funds and private equity structures.

-

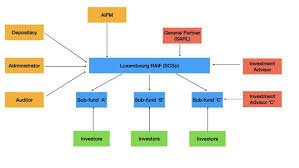

Luxembourg – Premier destination for UCITS and alternative investment funds.

-

ADGM & DIFC (UAE) – Offering strong regulatory environments for Middle Eastern and global investors.

-

BVI & Mauritius – Cost-effective and tax-friendly fund domiciles.

Advantages of Partnering with FundSetup

-

Full-Spectrum Services – From fund inception to closure.

-

Tailored Strategies – Customized solutions for every asset class.

-

Rapid Setup Timelines – Launch your fund faster without operational compromise.

-

Enhanced Investor Trust – Professional governance and transparent operations.

The Future of Fund Lifecycle Management

The industry is being transformed by technology, ESG mandates, and cross-border investment flows. FundSetup is ahead of the curve, adopting AI-driven analytics, blockchain-enabled administration, and green investment compliance to meet the demands of modern investors.

If you need a trusted, experienced, and globally connected partner for your fund lifecycle management, FundSetup provides the solutions, speed, and compliance to take your fund to the next level.

📍 Location: Dubai, UAE

📧 Email: info@fundsetup.net

📞 Contact: +971 52 888 1249